Your account at Qonto: business banking for entrepreneurs and the self-employed

Are you an entrepreneur and looking for a suitable business account? Qonto offers a banking service that is specifically tailored to the requirements of entrepreneurs – with high-quality design and the latest technology.

An entrepreneur has different rights to an account than a private person. Because in the business context it is no longer just a matter of appropriate account management fees, sufficient ATMs or being able to carry out your own transactions quickly and easily. If you need any account history then visit to accounting History blog.

Especially companies whose teams are growing quickly should rely on a business account that also gives new team members or freelancers access quickly – ideally with personalized limits and rights. And that’s not that easy to find.

The later Qonto founders Alex and Steve also had to experience this. For their first company together, they were looking for a business account in 2015 that met their requirements – to no avail. The business accounts that existed back then were all too complicated to use, too time-consuming and lacked modern financial management tools.

And so the two decided to revolutionize business banking for SMEs themselves and founded Qonto – a neo bank that offers entrepreneurs exactly what they need. At Qonto, it’s not your team that adapts to the account. But the account that adapts to your team.

The Qonto business account: it’s inside

With the Qonto business account , team expenses can be managed super easy, because every employee receives their own Qonto Mastercard. This can be done in a matter of minutes and can be completely personalized so that each employee has their own access, for which an individual limit can be set. All expenses such as expenses, transport, travel or marketing expenses can be managed independently – while an admin has a full overview of all expenses at all times and can adjust the set limits if necessary.

Employees can make transfers independently that only have to be approved by the admin – this simplifies workflows enormously. SEPA direct debits and collective transfers are also possible and also save time. You also benefit from the super-fast VIP customer support that you can reach at any time by email and phone. And all of this at fair and transparent prices.

The advantages of the premium business account from Qonto at a glance:

- Account opening in just ten minutes

- VIP customer support by mail and phone

- Virtual cards – ready for immediate use

- Clear overview of all expenses

- Personalized tags for a good financial structure

- Smart accounting functions such as unlimited sales history and separate account access for accountants

- Payment in foreign currencies

- German IBAN

Even more good reasons for Qonto:

Qonto is 100 percent digital and therefore much more sustainable (and faster) than a conventional bank with unnecessary bureaucracy and paperwork.

Qonto has its own core banking system and is therefore independent of the infrastructure of other banks – this also means 100 percent security for you as a customer.

Started in France, Qonto is now active in four countries, including Germany, Italy and Spain.

With QontoBoth physical and virtual payment cards can be created for all employees and are ready for immediate use. There is a large selection of payment cards. Whether Mastercard One, Plus or X (the first Business Metal Card in Europe, by the way): Each card adapts to the respective needs of its employee. You can set payment limits and your own PIN codes for locking and unlocking the cards. Everything is possible, from online payments with a 3D secure code to cash withdrawals at machines and other premium features. Every card is available in every tariff, also called plan at Qonto. As a self-employed person, for example, you can use the Solo Plan for nine euros a month and still apply for a Metal Card. Do you need an unlimited number of users for your many team members, choose the premium plan and receive up to five physical and an unlimited number of virtual Mastercards. Last but not least, every card comes with Mastercard insurance to protect you and other users.

Over 100,000 companies already use and love Qonto. This makes Qonto the fastest growing challenger bank in Europe. Do you want to be part of the movement? Then open your Qonto account now! New customers use the Premium Business Account for 30 days completely free of charge and without obligation.

A corporation is said to have fueled the tech share boom with $ 4 billion

Before the slump of the past two days, tech stocks in particular experienced an unprecedented boom . Tech companies such as Apple, Amazon, Facebook and Tesla have almost doubled their market value since spring. Apple, for example, became the first company in the world to reach a market value of two trillion dollars in August . According to coincident reports from the Wall Street Journal (WSJ) and the Financial Times , this price firework on the stock market could have been fueled by a single player.

Softbank: Boom triggered with call options?

According to the insiders quoted by the two renowned business newspapers, the Japanese Softbank group is said to have bought massive stock options on technology stocks in March, as the Handelsblatt reported. According to the WSJ, the purchase volume of the options is said to have amounted to four billion US dollars. Specifically, the whole thing is about so-called call options. These are options to buy shares at previously set – higher – prices. With put options, investors bet on falling share prices.

Because banks that offer call options have to have a correspondingly high number of the underlying shares in stock, these in turn drive the price further up. The options acquired by Softbank are said to have faced tech stocks valued at around $ 50 billion, according to the WSJ. In addition, Softbank is said to have spent another four billion dollars on shares in Amazon, Microsoft and Netflix, as well as a stake in Tesla. Softbank has not yet commented on this.

Big Five dominate US stock exchanges

The so-called Big Five, Apple, Microsoft, Amazon, Facebook and Google parent Alphabet, have pulled the overall market up with their massive price increases. After all, the five stocks make up almost a quarter of the S&P 500 index. Accordingly, market observers fear a general collapse in the stock markets if the tech stocks – as happened on Thursday and Friday – weaken.

Incidentally, Softbank is not likely to be the only player who has influenced the market with the strategy of call options. In the case of Salesforce, whose shares had shot up by 26 percent on the day the quarterly figures were announced, stock traders suspect such influence from an unknown investor. Incidentally, the Financial Times compares these investors with the so-called whales , who are said to own a large part of the existing Bitcoins and other cryptocurrencies. You can trigger large price fluctuations with purchases and sales.

Young professionals optimistic despite Corona

Accordingly, only ten percent of young professionals fear not to find a job in the next few years. However, many are apparently short of money: Only 16 percent are satisfied with their financial situation. That was the result of a representative survey of 1,043 young professionals by the opinion research institute Yougov. The client was the financial services provider Tecis in Hamburg.

At the same time, only a good third (34 percent) said that a high salary was important to them. A balanced ratio of work and leisure time (48 percent) and nice colleagues (47 percent) are therefore more important. In the survey, young people who are just about to complete their training or who have a maximum of two years of professional experience count as young professionals.

A majority sees the future in rosier colors than their current situation. Almost three quarters believe that they will be better off in terms of work, finances, living conditions and with regard to family and friends in five years. “Young people continue to rate their career opportunities positively – despite the recession, short-time work and unclear developments,” said Tecis board member Sönke Missfeldt. The company is part of the Swiss Life insurance group.

Framework data for the survey

The data is based on an online survey by YouGov in which 1,043 people took part between July 28th and August 14th, 2020. They were asked about their medium-term perspectives, their current life situation (job / career, finances, living and family / friends) as well as their current attitude to Corona. In future, this report will appear annually and show long-term developments in a barometer.

Among other things, the following questions were asked:

Which of the following aspects are particularly important to you in your professional life?

- high salary

- independent working

- Work-life balance (compatibility of work and private life)

- social commitment

- recognition

- flat hierarchies

- meaningful work

- Training opportunities

- Career opportunities

- something else, namely:

- nice colleague

- I do not know

- varied activities

What are you currently most concerned about?

- my financial situation

- Fear of not finding a job

- Fear of getting sick

- general uncertainty about the future

- Fear of not being able to cope with the course

- Losing family members or friends

- not having sufficient financial means in old age

- something else, namely:

- I’m currently not worried about anything

- don’t know (dpa / rw)

Slightly more women in management levels in public companies

The proportion of women in top jobs in large public companies has increased slightly. The organization “Women in the Supervisory Boards” (FidAR) determined this in a study.

22 percent women on the board of directors of public companies

No requirements for board members

Giffey calls for more commitment

Tesla factory building: first facade of production hall is up

Environmental approval for Tesla factory is pending

Critics worry about drinking water supplies

Objections will be discussed publicly on September 23

Tesla is looking for workers

Investments: EU companies are demanding concessions from china

Brussels and Beijing have been negotiating fairer competition for six years. The tensions between China and the USA are bringing new momentum to the talks. But is a breakthrough realistic?

In the opinion of European companies, China must make a big leap to successfully conclude an investment agreement with the EU.

“The European side has made it very clear that China cannot hit in the middle,” said Jörg Wuttke, President of the EU Chamber of Commerce, with a view to the top talks between the EU and Beijing planned for the coming week.

According to Wuttke, fair competitive conditions already apply in Europe – for both domestic and Chinese companies. In China, however, this is still not the case. Therefore, it is up to Beijing to “close the gap.”

Chancellor Angela Merkel , EU Council President Charles Michel and Commission President Ursula von der Leyen want to join the talks next Monday via video conference with China’s President Xi Jinping. One of the topics will be the planned investment agreement, which has been negotiated for six years.

Indeed, against the background of increasing tensions with the USA, China had recently been optimistic that it would be able to initiate an agreement with the EU. Chamber President Wuttke, however, was not very confident that a really comprehensive deal that would satisfy EU companies could be made.

According to Wuttke, the time window for an agreement with China is also closing. There must be an agreement this year. Wuttke justified this with the fact that Beijing is countering more and more political headwinds not only in the USA, but also in EU countries – for example because of human rights violations. An agreement is becoming more and more difficult.

From the point of view of Wuttke, who presented his chamber’s annual position paper on Thursday, China itself would benefit from opening up further. The economic growth of the People’s Republic could experience a significant boost. The Chinese economy has so far lagged behind its potential.

Despite the numerous problems caused by the ongoing decoupling of the USA and China, according to Wuttke, it is not a realistic scenario to withdraw from China. After all, the most populous country contributes 30 percent to global growth.

European companies have benefited from the fact that China brought the corona pandemic under control earlier than other countries . The current momentum in the Chinese market is impressive. European carmakers and numerous luxury brands did good business again.

China’s successful fight against Corona also brings problems for European companies, said Wuttke. Due to ongoing entry restrictions, it is still difficult for companies to bring employees back to China . Business trips are hardly possible either.

EU companies struggled with problems in issuing visas. Travelers who come to China also have to go into quarantine for 14 days in a hotel room. Only then are they allowed to move freely.

Liability risks for companies are increasing

Whether the chemical company Bayer or Volkswagen – several German companies were or are confronted with expensive class actions in the USA. But that’s not the only liability risk for companies.

According to an analysis by Allianz, companies are confronted with increasing liability risks – particularly through class actions and recalls. In the USA in particular, the courts are awarding plaintiffs against companies with ever higher amounts of compensation. Accordingly, the average settlement sum of the 50 largest US court judgments from 2014 to 2018 has almost doubled from 28 to 54 million US dollars, write the liability experts of the Allianz industrial insurer AGCS in their study published on Wednesday.

A growing number of product recalls is particularly noticeable in Europe. Accordingly, there were 475 recalls in the EU in the auto industry alone in 2019, eleven percent more than in 2018 (428) – and the highest value in the past decade. According to the AGCS study, the increasing concentration in the industry is contributing to the increasing risks. The Japanese airbag manufacturer Tataka has achieved particular fame in this regard. According to AGCS, this supplied 19 car manufacturers. After reports of injuries and fatal accidents, an estimated 60 to 70 million cars were recalled from 2002 to 2015, according to the study.

Chances and dangers from Corona

According to AGCS, the corona pandemic could have two effects on product safety in the food industry – both positive and negative. On the one hand, higher hygiene standards could even reduce the risk of contamination. On the other hand, the uncertainties of the epidemic with new business processes, temporary closings, working from home, fewer official controls and irregularities in the supply chains could pose new threats to product safety, warn the insurer’s experts.

Allianz sees two very different phenomena as a further risk for companies: the protest movements around the globe and environmental regulations, including indoor air quality. In the latter respect, the pandemic could have direct effects, according to the study: the risk of legionella and mold growth was exacerbated by the temporary closure of commercial buildings, hotels, fitness studios and other facilities during the pandemic.

This is how you get more out of short-time work benefits

Good news for short-time workers: the state is increasing payments and allowing more additional earnings. And those who do well can get even more out of it. The most important tips and tricks.

Due to the Corona crisis, the number of short-time working in Germany is reaching unprecedented levels. According to calculations by the Ifo Institute, 7.3 million employees were on short-time work in May – and other companies have registered short-time work for June. The previous negative record after the financial crisis in 2009 is 1.44 million short-time workers .

In order to mitigate the financial consequences for affected employees, the Bundestag and Bundesrat have decided to increase the short-time allowance . Those who are on short-time work at least 50 percent receive more money: From the fourth month onwards, the state pays short-time workers 70 percent instead of 60 percent of the lost net wage, from the seventh month onwards it is 80 percent. Parents even receive 77 percent (instead of 67 percent) from the fourth month and 87 percent from the seventh month. In addition, the regulations on additional earnings were relaxed.

The improved regulations should be a blessing for many. However, there are also some tax issues that need to be considered. Here are the most important tips and tricks:

Tip 1: be prepared for additional tax payments

So that short-time workers do not experience any nasty surprises later when you submit your tax return, you should know how the payments affect your taxation. First of all, the good news: The short-time work allowance is paid tax-free, so no taxes are deducted directly from the sum itself . However, the short-time work allowance is included in the calculation of the tax that you have to pay on your remaining taxable income. In order to determine the tax rate for this, the tax office includes the short-time work allowance as a fictitious income.

This results in a higher tax rate due to the tax progression. Since this is not yet taken into account in the employer’s payroll (i.e. you pay less tax at first), this point can lead to an additional payment later in the tax return. Anyone who has received short-time work benefits of more than 410 euros per year is obliged to submit a tax return and enter the amount in Appendix N, as the United Wage Tax Aid Association (VLH) emphasizes.

Tip 2: change the tax class

Since the amount of the short-time allowance depends on the monthly net salary, a change of tax bracket can be worthwhile for couples. “It is best if the recipient of the money chooses the tax class with the highest monthly net income, ie III or at least IV”, advises Stiftung Warentest . In this way, you receive more short-time work benefits, while tax disadvantages due to the less favorable tax bracket are compensated for in your tax return anyway. Practical: Since the beginning of 2020, married people and life partners have even been able to change their tax class several times a year.

Tip 3: enter the child allowance

In order to receive the increased short-time work allowance for parents, a child allowance of at least 0.5 must be entered on the electronic income tax card. This is usually the case automatically. There are exceptions, however: parents for children over 18 who are still in vocational training continue to be entitled to the tax exemption up to their 25th birthday – but they must actively apply for it.

In addition, Stiftung Warentest would like to point out that even for married mothers and fathers with tax class V, the child allowance is not automatically taken into account, as this is entered in the partner with tax class III. Therefore, an Elstam printout with the partner’s wage tax deduction features is required as proof for the higher short-time work allowance.

Tip 4: top up with a mini job

Collecting short-time work benefits and keeping the full money from a part-time job is now easier. Up until now, additional earnings were restricted to systemically important areas, which will no longer apply with Social Protection Package II. According to the federal government, the following applies from May 1 to December 31, 2020: “Anyone who takes up employment during short-time work can earn up to the full amount of their previous monthly income. The earnings earned are not offset against short-time work benefits.”

1200 euros basic income: what to expect from the new experiment

A scientific experiment on unconditional basic income is starting in Germany. How does the project differ from previous ones – and what insights can it bring?

The concept of an unconditional basic income is hotly debated. Proponents praise it as a humane alternative to Hartz IV that makes us all freer and happier. Critics see it as an invaluable social utopia for idlers. An attempt is now being made in Germany to put the discussion between these two ideological poles on an objective basis.

The non-profit association “Mein Grundeinkommen” is starting a pilot project together with the German Institute for Economic Research (DIW) and scientists from the Max Planck Institute and the University of Cologne, which aims to investigate the specific effects of such a basic income. It is not the first basic income experiment – but a special one. Because it is the first long-term scientific study of this kind for Germany . How the field test works and what findings it can bring:

How is the experiment set up?

Starting in spring 2021, 120 participants should receive a monthly basic income of 1200 euros – regardless of what else they earn or own. The money is paid out for three years. At the same time, a control group of 1,380 people is formed who do not receive the money, but who are examined in the same way as those receiving basic income. In this way it can be determined which changes are really due to the basic income.

The test participants of both groups will be selected from all persons who apply to participate on the project website . In order to keep the sample as representative as possible, the researchers hope to have one million applicants by November. The project is financed by donations.

What exactly is being investigated?

Participants in the study are regularly interviewed to find out how the basic income is changing their lives. It’s about the professional situation, but also questions of general satisfaction and health aspects. For example: do people work more, less or differently? To what extent do existential fears, stress and the risk of burnout decrease? What do people do with the additional financial security and what does it do with them? Some participants even want to evaluate hair samples.

How does the project differ from other basic income experiments?

The idea of an unconditional basic income has been and is being tried out in various countries. In a long-term experiment in Kenya, for example, thousands of people have been receiving a basic income equivalent to 20 euros a month for several years. However, the findings are often difficult to transfer. “Previous global experiments are largely useless for the current debate in Germany,” says DIW researcher Jürgen Schupp who was involved in the study .

The closest thing to us was another highly regarded experiment in Finland . The Finnish government paid an unconditional basic income of 560 euros per month for two years. The 2000 participants were all unemployed, however, as the Finns were primarily interested in the effects of the labor market. As these were not satisfactory, the project was discontinued. Participants from as many social classes as possible should now take part in the German experiment.

The topic is not entirely new in this country either. The Berlin association Mein Grundeinkommen, which has now initiated the pilot project, has been raffling off donation-financed basic incomes of 1,000 euros per month for a year for several years. ( Here winners report on their experiences. ) However, this experiment is not scientifically accompanied, so that no reliable statements can be made.

What findings can be expected?

In the Finnish experiment, the labor market effects were small, but the researchers found a number of other positive effects. The recipients of the basic income were “more satisfied with their lives and suffered less from psychological stress, depression , sadness and loneliness,” as the final report states. They also had more confidence in their fellow human beings and social institutions.

Many winners of the Mein Grundeinkommen lottery in Germany also report increased life satisfaction due to the additional security. In a non-representative survey of these winners, a majority said they were more courageous and curious. Most of them felt less pressure to perform, but more drive.

In the upcoming experiment, DIW researcher Schupp expects that some “who work solely for the money” will actually give up their jobs, he told the “Spiegel” . But he also knows from social science surveys that many would not turn their lives upside down if they received an unexpected cash gift of 10,000 euros. “Around half answered that they would not change anything and would not touch the money at all, but would put it in their reserves. I would not be surprised if a similarly high proportion of our basic income recipients would keep it that way.”

McDonald’s versus Burger King – that’s how the rise of the fast food empires began

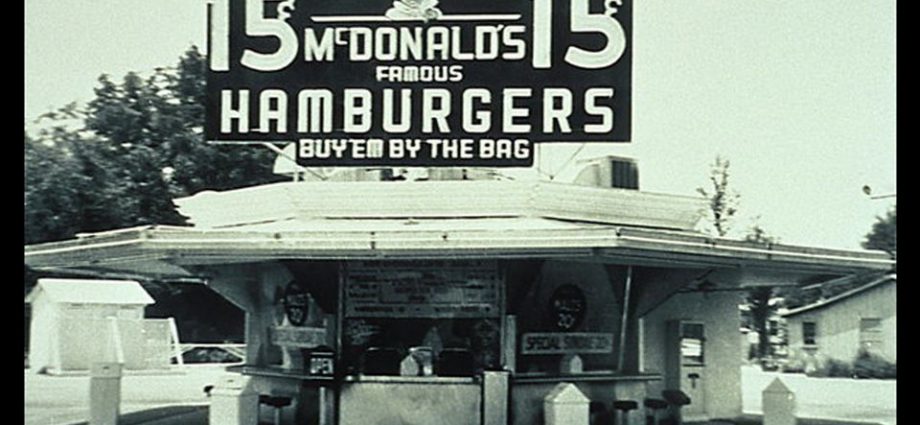

You can find a McDonald’s shop almost anywhere in the world today. But the fast food revolution, about which the new season of the podcast “Battle of the Businesses” tells, began very modestly in 1948 in San Bernardino, California. There the brothers Richard and Maurice McDonald, known as Dick and Mac, had developed a new concept for their diner, which had been in existence for several years, and which was soon to revolutionize the restaurant world.

They had saved the car controls that were common at American diners at the time, reduced the menu to the bestselling burgers, fries and milkshakes and developed a sophisticated system of division of labor in the kitchen – the “Speedee System”. The result: a 15-cent burger like on an assembly line and a flourishing business.

The success of the McDonald brothers caused a sensation in the American gastronomy scene. Nevertheless, under her leadership, McDonald’s would never have become the top-selling fast food company on the planet. The brothers were innovators who had perfected their own store, but attempts to have other stores operated by franchisees using the same system were only moderately successful.

Franchising and aggressive expansion

Until they met Ray Kroc, a milkshake mixer salesman, in 1954 and gave him responsibility for the franchise business. The ambitious businessman (impressively portrayed by Michael Keaton in the Hollywood film “The Founder”) set the course for nationwide expansion – with sometimes aggressive methods, as the McDonald brothers themselves later had to experience painfully. In 1961, Kroc bought McDonald’s from the founders for $ 2.7 million and was henceforth sole ruler of the brand. The McDonald brothers had to rename their pioneer shop San Bernardino and eventually shut down. Kroc had opened a McDonald’s next door to dig them up.

The success of the revolutionary fast food franchise business drew more avid businessmen. As early as 1954, around the same time Krocs started working at McDonald’s, David Edgerton, who had originally wanted to open a Dairy Queen ice cream shop, opened his first burger shop in Miami, Florida. The concept of the store called “Insta Burger King ” at the time was based on a new type of quick grill that grilled the burgers over an open flame. With his business partner James McLamore, Edgerton soon built up the biggest competitor of the McDonald’s empire, also in franchise style: the Burger King Corporation.

The new season of the podcast “Battle of the Enterprises”, the first episode of which was released on August 25th on Audio Now , Apple Podcasts and Google , tells of the rise and struggle of these two fast food giants . In the past few seasons, the German adaptation of the successful US podcast “Business Wars” has already been dedicated to the battle between Nike and Adidas, Coca-Cola and Pepsi, as well as Facebook and Snapchat.